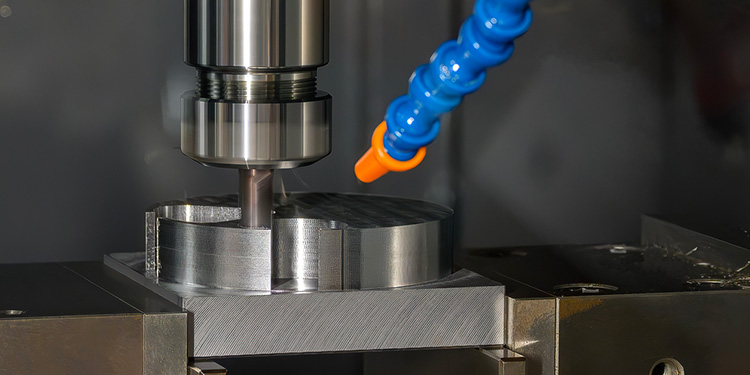

Cutting tools mean big business in the United States. The market represents $1.23 billion in annual shipments and is a leading indicator of manufacturing health, according to the June 2025 Cutting Tool Market Report by the Association for Manufacturing Technology and the U.S. Cutting Tool Institute.

You can get standard tools right off the shelf. But unlike selling fasteners or general MRO products, most cutting tools are application specific—and that makes them harder to spec, sell, and support.

For cutting tool manufacturers, the difference between making the sale and missing it often comes down to the depth of expertise on the ground.

While current market headwinds are affecting many industries, PE-backed cutting tool manufacturers face additional pressure. Many are navigating the fallout of consolidation—where internal expertise has been lost—and now need to justify their investments by assembling the right sales team. One that can streamline complex distribution channels and land the national accounts that move the needle on EBITDA.

Where Cutting Tool Sales Expertise Lives Today

Selling cutting tools through distribution is a sound strategy, but it requires more specialization than standard industrial products. These tools are more technical and application-specific, which means sales reps must understand the nuances of material types and which tool best fits the end user’s goals.

For example, a rep selling into aerospace needs to know the best drill that will perform consistently over thousands of holes in high-temperature alloys—not just that it fits the specs on paper.

That kind of expertise used to reside in-house—either with engineers or in-house sales reps. But the M&A landscape has shifted that knowledge to the field, into the hands of independent manufacturing representatives (IMRs) like Durrie Sales.

Durrie’s cutting tool team includes boots-on-the-ground sellers like Dan McVicker, a technical sales associate who combines deep product knowledge with strong distributor relationships. That blend helps manufacturers protect their business and defend accounts from competitors.

In fact, Durrie often helps manufacturers custom-design tools to win deals and keep competitors out. It’s harder for another rep to re-engineer and replace the business when the solution is tailored to the application.

Private equity firms managing manufacturing companies may be losing internal technical knowledge during consolidation—but with the right IMR partnerships, they gain specialized market intelligence, channel access, and agility.

Retooling Your Cutting Tools Distribution Channel Strategy

Regardless of your product line, the rules of cutting tool sales have changed. Traditional distribution models no longer guarantee success. The variables are complex: product availability, channel loyalty, and shifting buyer preferences.

IMRs offer visibility and velocity. Their deep knowledge of local markets and distributor relationships enables manufacturers to make faster, more strategic decisions. That includes:

- Identifying top SKUs that deliver margin and velocity

- Aligning those SKUs with ready-to-buy accounts

- Accelerating time-to-revenue by selling what’s in stock

Instead of spreading your efforts across 100 SKUs, IMRs help you focus on the 20% that drives 80% of profits.

Strategic Selling in a Changing Landscape

The best reps do more than take orders. They help manufacturers answer hard questions, like:

- Which distributors are truly committed to our line?

- What industries should we focus on?

- How do we get closer to key end-users in targeted verticals?

Durrie Sales has a pulse on distributor priorities and customer trends—and they use that insight to position cutting tool manufacturers for long-term growth.

Their reps don’t just show up with catalogs. They show up with application-specific strategies that improve performance and generate cost savings.

Why It Matters for PE Firms

Cutting tool sales isn’t a plug-and-play channel. It takes time, relationships, and experience to move the needle—especially with large end users and national accounts.

For private equity firms that want to protect their investment and generate predictable returns, IMRs offer an integrated path to value creation:

- Faster end-user access

- Better distributor alignment

- Higher-margin product mix

- Lower cost of sales

And perhaps most critically: an experienced, agile sales partner who can adjust to market conditions in real time.

The Bottom Line

In cutting tools, it’s not enough to be on the line card. You need to be on the shortlist of strategic suppliers.

Durrie Sales help cutting tool manufacturers develop long-term relationships with distributors and end users that are increasingly difficult to land alone. With deep application knowledge, tailored solutions, and decades of channel insight, they serve as true growth partners—not just intermediaries.

For PE-backed manufacturers navigating consolidation, shifting buyer behavior, and the complexity of national distribution—an experienced rep team may be your best-kept secret to unlocking sales velocity and long-term value.

Partner with Durrie Sales to strengthen your distribution strategy and secure your next big account.